Education remains one of the most important ministries of the Church in India. However, there is a lack of clarity regarding the line of authority and role and responsibilities of the different officials responsible for the running of the institution, be it school or college. Here I attempt to clarify these. However, I attempt to present a role clarity from a Jesuit point-of-view. Readers may adapt it according to their specific situation and practices.

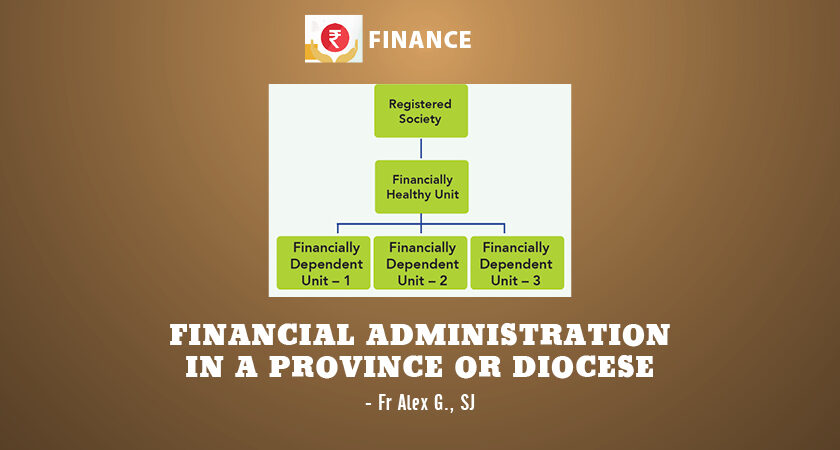

The Governing Body of the registered society, under whose authority the school functions, is the top-most legal body responsible for the policies, decision-making and running of the institution. Thus, as the ex-officio President of the Governing Body, the Provincial/Bishop remains the head. The President exercises his/her authority in line with the Memorandum and Bye-laws of the registered society. However, he/she exercises this authority through the local Superior, who in some cases, may be the ex-officio Vice-President of the registered society, where that’s the only institution run by the society.

Fr Alex G SJ

To read the entire article, click Subscribe